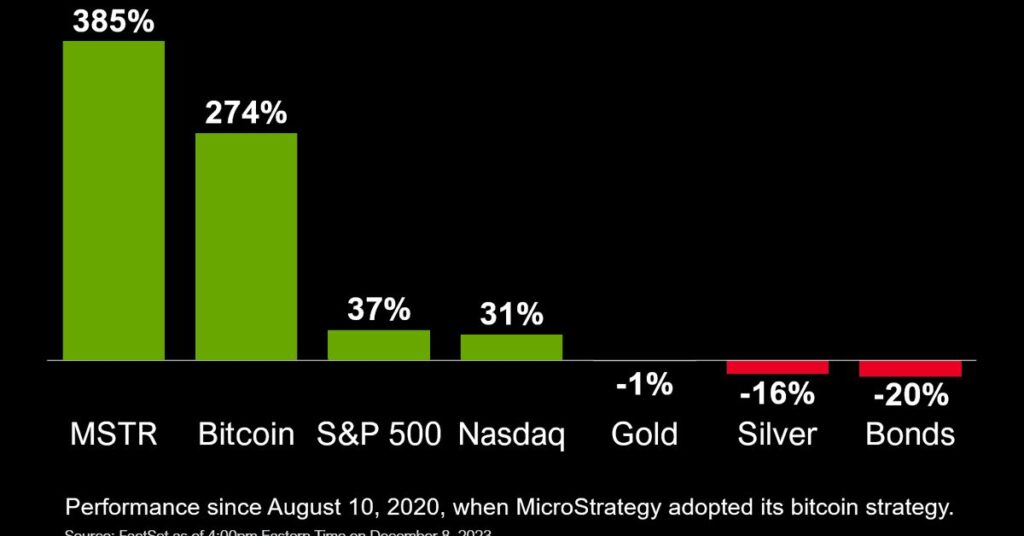

In uncertain markets, the search for clarity often leads us back to the wisdom of presence, perspective, and purpose. As many investors chase momentum and noise, a deeper look reveals that the quiet, steady conviction behind MicroStrategy—now rebranded as Strategy—offers more than financial speculation. It offers a case study in deliberate action, high-stakes belief, and long-term vision. For those navigating volatility with mindfulness, Strategy’s path may provide insight into how patience, discipline, and clarity can create not just returns, but resilience.

MicroStrategy (NASDAQ:MSTR), now operating under the name Strategy, continues to make headlines for its unwavering accumulation of Bitcoin. As of early May 2025, the company holds over 555,000 BTC, up from approximately 386,700 at the start of the year. This bold strategy—led by executive chairman Michael Saylor—signals more than bullishness; it reflects a profound commitment to a long-term thesis, where Bitcoin is seen as a superior store of value amid rising inflation, geopolitical instability, and digital transformation.

At an average purchase cost of $68,550 per bitcoin, Strategy’s position is now well in the green, showing unrealized gains of nearly $15 billion. The company’s total spend of $38.08 billion dwarfs the holdings of any other publicly traded firm, illustrating its intent not just to participate in the crypto cycle, but to lead it. With YTD returns of 14%, Strategy’s BTC treasury is also outperforming many traditional indices, including QQQ and SPY, even amid market-wide uncertainty driven by trade tensions and interest rate speculation.

While some remain wary of the volatility tied to such aggressive accumulation, a closer analysis of the BTC/MSTR ratio reveals a nuanced picture. This key metric, which prices Bitcoin in shares of Strategy, is sitting at a historical support level not seen since the 2018–2019 bear market. Should this ratio break down, it would suggest that MSTR could enter a phase of sustained outperformance—offering investors an equity-based, high-leverage proxy for Bitcoin’s long-term movement without the direct custody complexities.

Moreover, with current projections estimating that Strategy could end 2025 holding over 700,000 BTC, the bullish case intensifies. Applying past NAV premiums of 2.5x to 3x on a projected BTC value of $150,000, Strategy’s share price could reasonably rise to a range between $1,200 and $1,600. Though such figures are speculative, they demonstrate how traditional equity investors might access crypto upside while leveraging the company’s growing AI and data analytics offerings—areas increasingly drawing attention from both CNBC and retail platforms like Robinhood.

Still, concerns persist. April’s acquisitions alone totaled over $1.9 billion, raising questions about overexposure and debt strategy. A 3.9% dip in MSTR stock following its May purchase announcement reflects the market’s mixed reception. As with any bold move, risk and reward walk side by side. Yet the calm persistence of Strategy’s approach mirrors elements of mindful investing: sustained focus, disciplined entry, and alignment with long-term vision.

From a Buddhist lens, Strategy’s actions may be interpreted not merely as market maneuvers, but as a form of intentional living—bold, clear, and grounded in conviction. Where others react, this firm responds. Where some chase trends, Strategy cultivates position. Whether this approach leads to outperformance remains to be seen. But the deeper lesson is clear: clarity and intention often precede reward.

Data Table: Strategy vs. Bitcoin and Key Indices

| Metric | Strategy (MSTR) | Bitcoin (BTC) | SPY (S&P 500 ETF) | QQQ (NASDAQ-100 ETF) |

| YTD Return (as of May 4) | +14.0% | +11.8% | +5.6% | +7.2% |

| Avg BTC Cost Basis (MSTR) | $68,550 | — | — | — |

| Current BTC Price | ~$95,000 | ~$95,000 | — | — |

| Est. Share Price Target 2025 | $1,200 – $1,600 | ~$150,000 (BTC) | N/A | N/A |

How much Bitcoin does Strategy (MSTR) currently hold?

As of May 4, 2025, Strategy holds approximately 555,450 BTC, acquired at an average cost basis of $68,550 per bitcoin, for a total spend of about $38.08 billion.

What is the current value of Strategy’s Bitcoin holdings?

With Bitcoin trading around $95,000, Strategy’s BTC holdings are worth over $52.8 billion, resulting in an unrealized gain of nearly $15 billion.

What is the BTC/MSTR ratio, and why does it matter?

The BTC/MSTR ratio measures Bitcoin’s price relative to MSTR stock. It helps investors assess whether MSTR is outperforming or underperforming BTC. Currently, the ratio is near a key historical support level, which could signal a major shift in relative strength.

What are the projected price targets for MSTR stock?

If Bitcoin reaches $150,000 in this cycle and Strategy maintains a NAV premium of 2.5x to 3x, MSTR shares could reach $1,200 to $1,600 by the end of 2025, depending on BTC holdings and market conditions.

How frequently is Strategy acquiring Bitcoin?

Strategy has been acquiring BTC on a regular weekly basis, including two recent large purchases in April totaling over $1.9 billion. The latest single acquisition was 1,895 BTC for $180.3 million, bought at an average price of $95,167.

Is MSTR considered a leveraged play on Bitcoin?

Yes. MSTR is widely regarded as a high-beta proxy for Bitcoin, offering equity investors leveraged exposure to BTC performance without owning Bitcoin directly.

How is Strategy involved in AI and technology development?

Beyond Bitcoin, Strategy has also been developing AI-driven analytics solutions, enhancing its profile among tech and institutional investors.

What is the market sentiment toward MSTR among retail investors?

MSTR is one of the most popular stocks on Robinhood in 2025, indicating high interest from retail investors who often respond to momentum, trend alignment, and perceived undervaluation.

Peaceful Takeaways:

- Practice Discernment: Like Strategy’s deliberate purchases, make financial decisions based on long-term clarity, not short-term emotion.

- Balance Risk with Reflection: Bold moves require deeper awareness. Pause, consider all sides, and act from centered insight.

- Value Conviction Over Consensus: True confidence isn’t loud—it’s consistent. Choose paths that align with your values, not just the market’s volume.

- Invest with Intention: Let your investments reflect your understanding of impermanence, interdependence, and mindful growth.

Would you like this formatted for your website’s publishing platform?